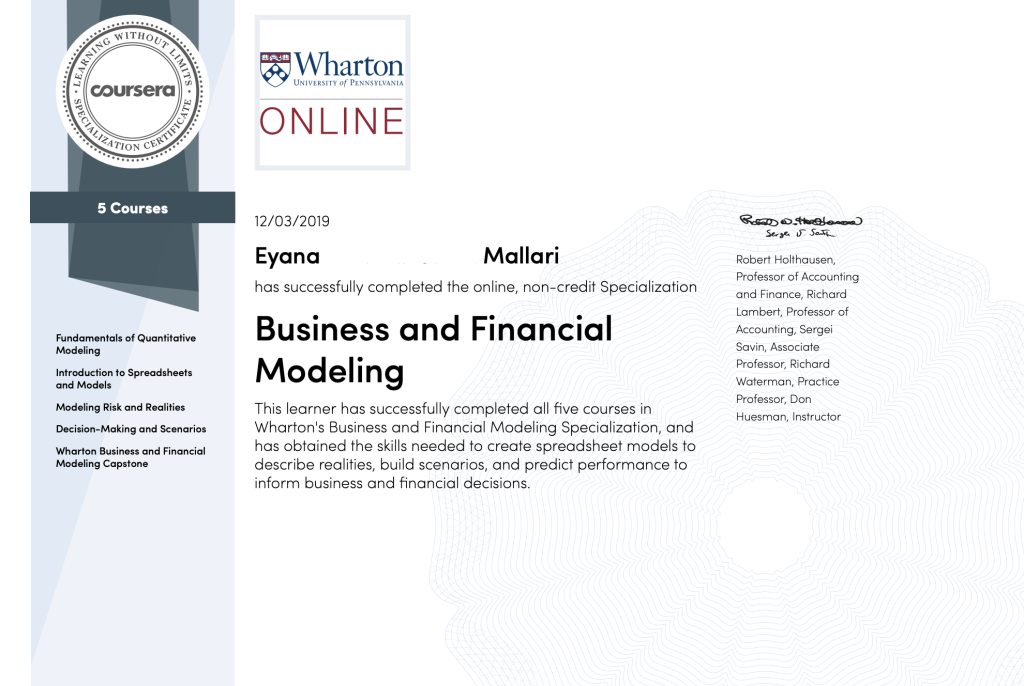

I recently completed a Coursera specialization on Business and Financial Modeling. Surprisingly, I had fun spending eight weekends immersed in lecture videos, Math formulas and Excel workbooks.

Math isn’t exactly my cup of tea, but I found myself doing a lot of data modeling and forecasting in my day job. So I figured that I needed to enhance my practical experience with a bit of academic training.

The specialization is offered by Wharton (one of my dream B-schools!) and is designed for beginners like myself. Anyone is capable to complete the courses with basic Calculus, Statistics and Excel skills as pre-requisites.

Let me give my feedback on each of the five courses I completed for this specialization.

Fundamentals of Quantitative Modeling

“All models are wrong but some are useful.”

This course aims to introduce the basic terms and concepts used in quantitative modeling—a perfect starter for the specialization! It also covers industry examples to illustrate the concepts learned.

Key concepts learned: empirical vs. theoretical, modeling process, basic mathematical functions and applications, deterministic models (classical optimization), probabilistic models, regression analysis

Difficulty: 2/5

Rating: 4.5/5

Introduction to Spreadsheets and Models

This course aims to demonstrate how to use Excel in creating models, and thus more practical. I learned more about the Data Analysis toolpack and Solver function in Excel, which would be handy in the next courses. Aside from these teels, there’s nothing new to learn here if you eat Excel workbooks for breakfast.

Difficulty: 3/5

Rating: 4/5

I rated this lower than the first one simply because fellow students find the quizzes cumbersome to take, due to bugs. I had to be extra mindful when entering formula in the answer sheets.

Modeling Risk and Realities

This course is heavy on Statistics and Calculus. I also like how the module combined the concepts learned in the first course and practical tips from the second course.

I learned how to build basic optimization models in Excel using these 3 major components: decision variables, objective function and constraints. Optimization is a method of finding the value of an input the maximizes or minimizes an output. In the business context, this is useful in making financially-sound decisions.

I was also introduced on the concept of risk, which is defined as the likelihood of an undesirable outcome. Some decision makers may use standard deviation to spot risks.

Difficulty: 4/5

Rating: 4.8/5 (My favorite out of the 4 modules!)

Decision-Making and Scenarios

This course leans toward accounting, finance and a bit of portfolio management. I learned about the concept of Net Present Value and how to use it in evaluating projects.

As an Information Systems major who barely remembered anything on her one accounting class, I find this course a bit overwhelming. But I’m glad to re-learn how to read basic financial statements: balance sheets, income statements and cash flows.

If there is one thing I would like to learn more in business, it’s finance. I would say that this course served as my actual introduction, and helped me reduce my nonsensical fear of numbers.

Difficulty: 4/5

Rating: 4.5/5

Wharton Business and Financial Modeling Capstone

Coursera only allows students to start the capstone project once the four required courses (discussed above) are completed. Using the concepts learned in the past modules, we were tasked to recommend the most optimal asset allocation to an investor with $5M capital.

To complete the task, I had to do my research and calculate the optimal risk ratio for both investment options. In creating the presentation, I also applied the consulting framework I often use at work.

I’m glad that my final output was well-received in peer reviews. Here’s my final capstone project: Click here

Final Words

As someone who got bad grades in Math, I couldn’t believe I finished the specialization. I actually appreciate numbers when applied in business context. If I could do it, anyone can do it as well!

I would highly recommend this specialization to people like me, a young professional who wants to start conquering their fear of numbers. The real-life examples used in the modules helped them understand the concepts a lot better. I’m the type of learner who cannot learn theories alone.

Did this specialization help me at my job? It sure did. I’ve used the Data Toolpack in one of my analyses. The mental models I learned here made me rethink about my reporting methodologies and how I choose my stocks.

One more thing: This can also be a good introduction to more advanced courses in Statistics, Accounting or Finance.

-EM

Leave a comment